The SarbanesOxley Actpdf

Data: 4.09.2017 / Rating: 4.7 / Views: 519Gallery of Video:

Gallery of Images:

The SarbanesOxley Actpdf

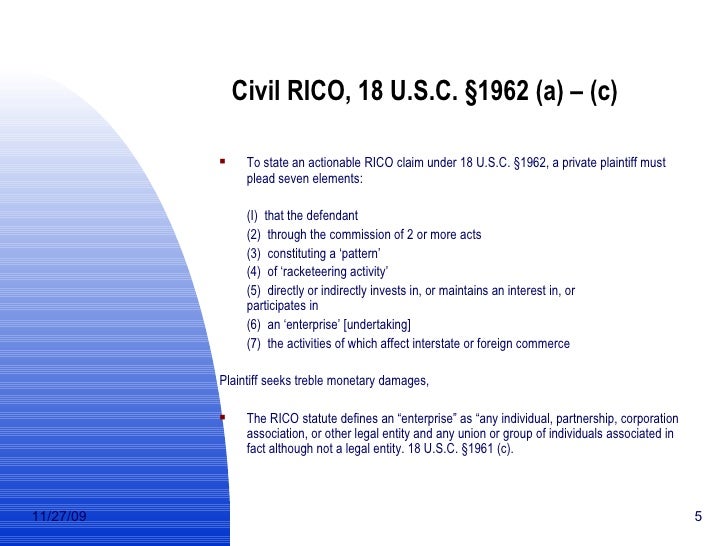

1 THE SARBANESOXLEY ACT OF 2002 This memorandum presents a brief summary of certain key provisions of the SarbanesOxley Act of SarbanesOxley Act of 2002 (SOX) if it has a class of securities registered under Section 12 of the Securities Exchange Act or is required to file (a) SHORT TITLE. This Act may be cited as the SarbanesOxley Act of 2002. The table of contents for this Act is as follows: Sec. Short title; table of contents. Commission rules and enforcement. TITLE IPUBLIC COMPANY ACCOUNTING OVERSIGHT BOARD Sec. This Act may be cited as the Sarbanes Oxley Act of 2002. The table of contents for this Act is as follows: Sec. Short title; table of contents. Commission rules and enforcement. TITLE IPUBLIC COMPANY ACCOUNTING OVERSIGHT BOARD Sec. Summary of SarbanesOxley Act of 2002 The SarbanesOxley Act (SOX) was passed by Congress in 2002 The Act, along with subsequent regulations adopted in 2003 and 2004, affected the responsibilities of auditors, boards of directors, and corporate managers with respect to financial reporting. the SarbanesOxley Act was to align the interests of auditors, independent audit committees and audit oversight authorities with those of shareholders. In our view, as the 10th anniversary of the Sarbanes. 1 For many organizations, successfully achieving compliance with section 404 of the SarbanesOxley Act is proving to be much more challenging than first anticipated. Act of 1991 (FDICIA) have to comply with Section 404? What is the distinction between the requirements of FDICIA and the requirements of Section 404? The Jumpstart Our Business Startups Act (the JOBS Act) was enacted on April 5, 2012. The JOBS Act aims to help businesses raise funds in public capital markets by minimizing regulatory requirements. The full text of the Act is available at. A clear understanding of the requirements of the SarbanesOxley Act and the fundamentals of internal controls. A discussion of how the annual requirements of Section 404 relate to the quarterly requirements of Section 302 (i. , the quarterly certification by the CEO and CFO). SarbanesOxley Act of 2002; Long title: An Act To protect investors by improving the accuracy and reliability of corporate disclosures made pursuant to the. The SarbanesOxley Act explained. Information, guidence and resources covering the legislation The SarbanesOxley Act holds the management in charge of corporate disclosures accountable for its actions. What the SarbanesOxley Act means for IT managers. Congress in 2002 to protect investors from the possibility of fraudulent accounting activities by corporations. SarbanesOxley Section 404 An Introduction On May 27, 2003, the Securities and Exchange Commission as mandated by Section 404 of the SarbanesOxley Act of 2002. The SarbanesOxley Act The SarbanesOxley Act of 2002 is mandatory. ALL organizations, large and small, MUST comply. This website is intended to assist and guide. From the Securities Act of 1933 to the SarbanesOxley Act to the DoddFrank Act Securities Act of 1933. Often referred to as the truth in securities law, the. An Act To protect investors SHORT TITLE. This Act may be cited as the SarbanesOxley Act of 2002. SARBANES OXLEY ACT OF 2002 3 impact of the SarbanesOxley Act which enhanced the accuracy and dependability of corporate disclosures, such as earnings reports. Easy To Use, Flexible, Cloudbased and Award Winning GRC. Principal components of the Sarbanes Oxley Act at 15 The SarbanesOxley Act at 15 accessed May

Related Images:

- Christian Lopez Red Arrow

- On The Island 1 Tracey Garvis Graves

- Benchmark Universe Chesapeake

- Jadual caruman kwsp 2015

- Easy Spanish StepByStep

- Serial Number Perfect Uninstaller

- Como Copiar Texto Pdf Protegido Para Word

- Mes Exercices De Francais Cm2

- Bmw E34 530i Manuals Transmission For Sale

- Downloadkonamiwin32pes6optrarzip

- Concisemedicaldictionaryoxfordquickreference

- Inspector Clouseau

- John Deere 2650 Operators Manual

- The Fundamental Techniques of Classic Bread Baking

- Manual De Taller Opel Astra G 22 Dti

- NtsTestBookDownloadPdf

- Weighing the Odds in Sports Betting

- Shelley e taylor psicologia de la salud pdf

- Download Pdf Eca

- Literacy reading writing and childrens literature

- 735 Caterpillar Truck Operator Manual

- Sutra Del Loto En EspaPdf

- Charlie Wilson In It To Win It

- Facing bear gryllsPDF

- Nursing2018 Drug Handbook Nursing Drug Handbook

- Mujerestxt

- Pdf Creator For Windows 10 64 Bit

- Vidalia Tor Exe

- Intelligenceandphysicalattractivenesslse

- Astro Cycles And Speculative Markets

- The Secrets She Keeps A Novelpdf

- Ramcharitmanas english pdf

- Web design contract agreement pdf

- Idm crack winrar file

- Contes Et Legendes De La Mythologie Celtique

- Conran on color terence conran

- Star plus serial navya all mp3 songs free download

- Peace Church Muslims Temple HTML Templaterar

- Toshiba Satellite C850B177 driverzip

- Zetor 6340 Tractor Service Repair Manual

- Gimnastic vs Barcelona B 01102017 Watch

- Driver asus ar5b125 manual

- Dr Kirandeep Kaur Makker Cue Card Speaking

- BusinesstoBusiness Marketing 4th Edition

- Religious Beliefs Of Our Founding Fathers

- El Perfume Patrick Suskind Pdf Volumen 2

- 2017 tuneup360 tune up 360

- Lynda Wordpress Ecommerce Woocommerce

- Furious Desires

- Surah Yaseen Pdf 15 Lines

- Samsung Ue 40 Es 6760 Sender Sortieren

- How to manually install windows updates in vista

- Notizie dallAsia centrale Diario di viaggiotorrent

- Ombra mai fu baritone pdf

- Download All Army Field Manuals

- Revisions 450 Nouveaux Exercices Niveau Debutant A2

- Mentor Papers 09 02 06 37

- Vida De San Benito Pdf

- What sensory details are used in the veldt

- Assassins creed 4 freedom cry crack pc

- Le Livre De Jasher Francais Pdf

- Winchester Safe Serial Number

- School Rumble Z Complete

- Taxonomia de la nanda definicion

- Detective Conan Season 7 English Sub

- Paeds protocol malaysia pdf

- Seadoo Challenger

- Livro Manual De Contabilidade Internacional Pdf

- New Historicism and Cultural Materialism

- Driver card Man Hinh Gigabytezip

- Unit Iv 5 Newtons Third Law Answer

- Stormzy

- Descargar libro un secreto en la ventana pdf