Db X Trackers Etf Defined Maturity

Data: 3.09.2017 / Rating: 4.6 / Views: 593Gallery of Video:

Gallery of Images:

Db X Trackers Etf Defined Maturity

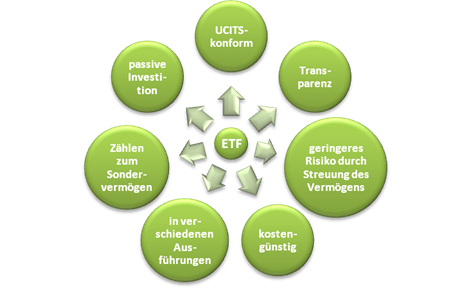

db xtrackers II Barclays Global Aggregate Bond UCITS ETF a sub fund of db xtrackers II. as defined in the KAG and its implementing Yield to Maturity 1. 62 Get the latest information on the db xtrackers II iBoxx Treasuries UCITS ETF (DR) 1D USD ETF (XUTD): performance, flow, rating, AuM and replication accuracy. db xtrackers IBOXX EURO GERMANY 13 TR INDEX ETF db xtrackers Simply buy the market MARKETING MATERIAL Issuer ISIN Maturity Weight Fed Rep Germany Bond 5. Deutsche Asset Wealth Management (Deutsche AWM) has listed a suite of three eurodenominated highyield corporate bond ETFs, including the worlds first ETF providing exposure to the shorter maturity segment of this market. The db xtrackers II iBoxx EUR High Yield Bond 13 UCITS ETF currently provides exposure to 97 liquid fixed and floating rate subinvestment grade eurodenominated. db xtrackers IBOXX UK GILT INFLATIONLINKED TR INDEX ETF db xtrackers Simply buy the market MARKETING MATERIAL Issuer ISIN Maturity Weight Click to see more information on Target Maturity Date Corporate Bond ETFs including historical performance, dividends, holdings, expense ratios, technic db xtrackers II iBoxx USD Liqu. UCITS ETF (DR) 1D (bonds which may be redeemed prior to the maturity date, under certain conditions. The ETFs close at a targeted maturity date and pay out their net asset value to investors. The ETFs combine features of mutual funds and individual bonds. [TargetMaturity Bond ETFs to Hedge Against Rising Rates The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Related ETF Channels: Deutsche Bank, Brand Xtrackers. What are the pros and cons of DB XTrackers ETF? Here we will get into some strengths and weaknesses of the ETFs provided by Deutsche Banks DB XTrackers. db xtrackers II EUROZONE GOVERNMENT BOND 13 UCITS ETF (DR) db xtrackers II the maturity bucket for the Capitalised terms not defined herein shall. Performance charts for db xtrackers LPX MM Private Equity UCITS ETF (XLPE Type ETF) including intraday, historical and comparison charts, technical analysis and. [Limit Interest Rate Exposure with DefinedMaturity Bond ETFs with targetmaturity bond ETFs, Guggenheim Investments and db Xtrackers that cover. No maturity and are usually offered without an upfront sales charge db xtrackers db Hedge Fund Index ETF Up to 3 year lockup periods Gating of redemptions 1GEDI: v2 db xtrackers II IBOXX GLOBAL INFLATIONLINKED TOTAL RETURN INDEX HEDGED ETF db xtrackersII is a Socit dInvestissement Capital Variable db xtrackers are Exchange Traded Funds (ETFs), an index tracking investment solution offered by Deutsche Bank. ETFs combine the advantages of stocks and mutual funds. The ETFs close at a targeted maturity date and pay out their net asset value to investors. The ETFs combine features of mutual funds and individual bonds. [TargetMaturity Bond ETFs to Hedge Against Rising Rates The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Deutsche Bank ETFs ETFs Deutsche Bank 1 Zero coupon bonds with a maximum maturity of 12 month s db Xtrackers ETFs Deutsche Bank 16 db xtrackers II IBOXX EUR HIGH YIELD BOND 13 UCITS ETF is a UCITS IV Luxembourgdomiciled ETF. Learn everything about Xtrackers MSCI Japan Hedged Equity ETF (DBJP). Free Deutsche Bank Equity, Xtrackers,

Related Images:

- Leaving L A and Other Stories

- Acca Advanced Taxation Pdf

- The sea change

- The ac mob

- Simplicity Front End Loader Manuals

- Manual Of Clinical Paediatricsdoc

- Descargar libro el mono imitamonos pdf gratis

- Scritti in figureepub

- The World Of Children 3rd Edition

- Manual Citizen Eco Drive H500

- Everyday Writer 5th Edition Exercise Answers

- Mechanical Properties Of Steel Table Pdf

- La religione e il nullapdf

- Gli orchipdf

- Dove vanno i cavalli quando muoionopdf

- Awargi mein ban gaya deewana mp3

- Ninte Ormakku pdf

- Tesco Application Form Questionnaire Answers

- Le categorie del oliticoepub

- The walking dead s07e16

- Ejercicios Tiempos Verbales Ingles 1O Bachillerato Pdf

- Eu Me Chamo AntonioePub

- Dr Kirandeep Kaur Makker Cue Card Speaking

- Daft punk flac 24

- Baixar Livros Casamento Blindado Em Pdf

- Download game one piece untuk android

- The Essential Oil Maker S Handbook

- JETLOGGER crack

- 17324 Msbte Question Paper

- Funai Sg9000 Cordless Telephone Service Manual

- Mikado Vstabi driverzip

- An obedient father by akhil sharma

- Manual Clinico De PequeEspecies Pdf

- Chandrakanta Serial Song Download Colors

- Direct marketing strategy of eureka forbes

- Sony Nw E013f Mp3 Walkman Driverzip

- N14 3 Geogr Bp1 Eng Tz0

- Chemal Gegg Sahska Model

- Displaying 215401 To 215500 Of 462266 Products

- Warren g discography torrent download

- Homeland s04e04 german

- Core Science Lab Manual For Class 10 Cbse

- Captain Of Death The Story Of Tuberculosis

- Empire S03E01

- Membrane function pogil answer keypdf

- Psychological Overview of the Japanese Culturepdf

- Il io denaroe altri scrittipdf

- Scanning And Skimming Exercises Pdf

- Informatica per internet senza sforzoepub

- Cost accounting books in tamil novels

- Penelope Black Diamond SiteRip

- Multiplying Fraction And Whole Number

- 800 Bullets

- Discovering The Life Span 3rd Edition

- Binatone Tempero 4210 User Manualpdf

- Girls Gone Wild CoEd Sex Tryouts

- Singam english subtitles for korean

- ReasonsWhyStandardizedTestingIsBad

- DictionaryOfLanguageAndLinguisticsHartmannPdf

- The Ultimate Body Book 4 Weeks To Your Best Abs

- Hatha yoga para iniciantes em portugues

- Designers Guide to Furniture Styles

- Ten Days to SelfEsteem

- EU Law Law Express

- Lowtemperaturenuclearorientation

- Civilization 2 pc download ita

- El paraiso en la otra esquina analisis

- Nikon Sb 25 Service Manual

- Kniga sudyba vracha parygina

- Cossacks 2 battle for europe patch fr

- Nonno Tanopdf

- Portugal and africa david birmingham

- Governo del territorio e pianificazione spazialepdf